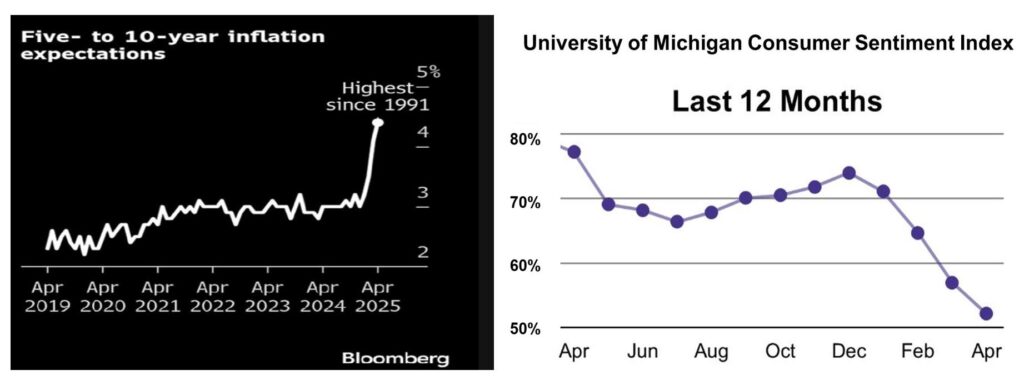

Moody’s and S&P aren’t just handing out grades—they’re signaling a deeper loss of faith in America’s ability to manage its finances.

On May 16, 2025, Moody’s Investors Service downgraded the U.S. Treasury’s credit rating from Aaa to Aa1, sending a clear signal: doubts about America’s long-term fiscal health and political gridlock are getting too big to ignore. For decades, U.S. Treasuries were as close to “risk-free” as it gets, but that reputation is looking shakier by…

Read more