Announcment: TSAM – The Summit for Asset Management

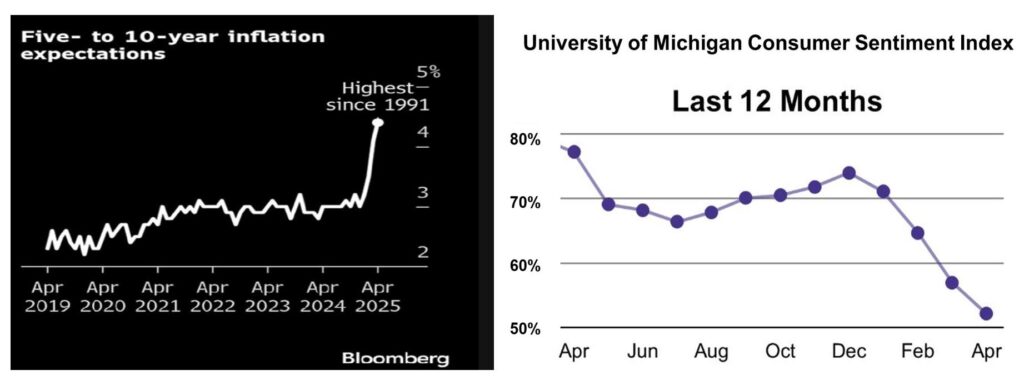

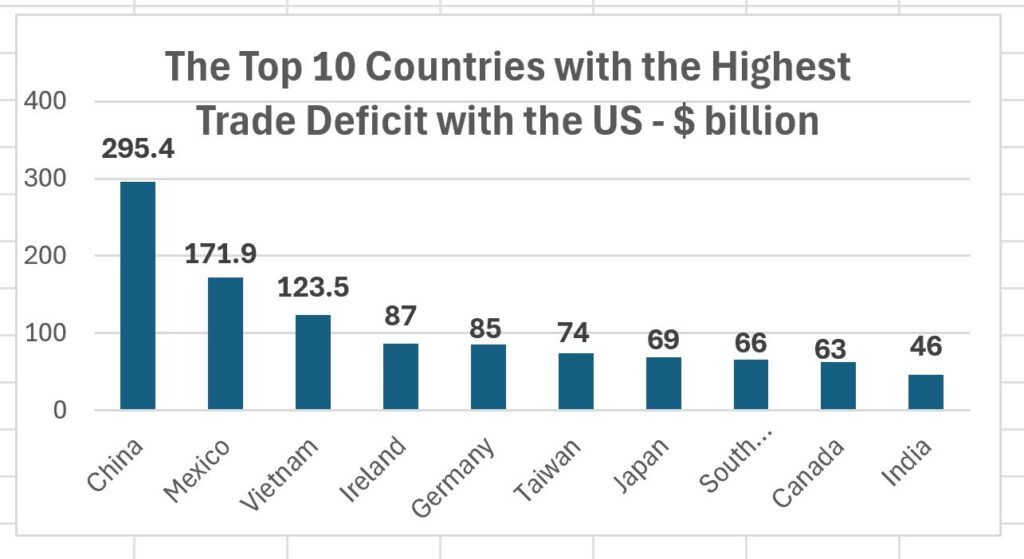

We’re honored to have Ned Gandevani, MBA, Ph.D., Economist, Fund Manager, Financial Strategist, and Harvard Business School faculty member join us as one of the headline speakers at TSAM Boston on June 2nd, at the Renaissance Boston Seaport Hotel. With global markets navigating volatility, geopolitical risk, and inflationary pressure, Dr. Gandevani will deliver must-hear insights…

Read more