Will the bulls keep running in 2025?

What a year for Wall Street. The S&P 500 just wrapped up 2024 with a stunning 26.90% total return – that’s 25.18% from price gains and another 1.72% from dividends. Not bad for a year that started with plenty of skeptics.

The rally’s secret sauce? A perfect storm of catalysts. The AI revolution sent tech stocks soaring, political uncertainty faded after the U.S. elections, and the American economy proved remarkably resilient. Add in the Federal Reserve’s pivot toward rate cuts and a broader market rally that lifted stocks beyond just the usual tech suspects.

Speaking of tech – five companies turned into absolute juggernauts this year. Nvidia led the charge with a 16.9% contribution to the index gains, followed by Apple at 5.7%, Amazon at 5.4%, Meta at 4.6%, and Microsoft at 4%. Together, these five titans powered about 37% of the entire U.S. market’s gains. Talk about carrying the team.

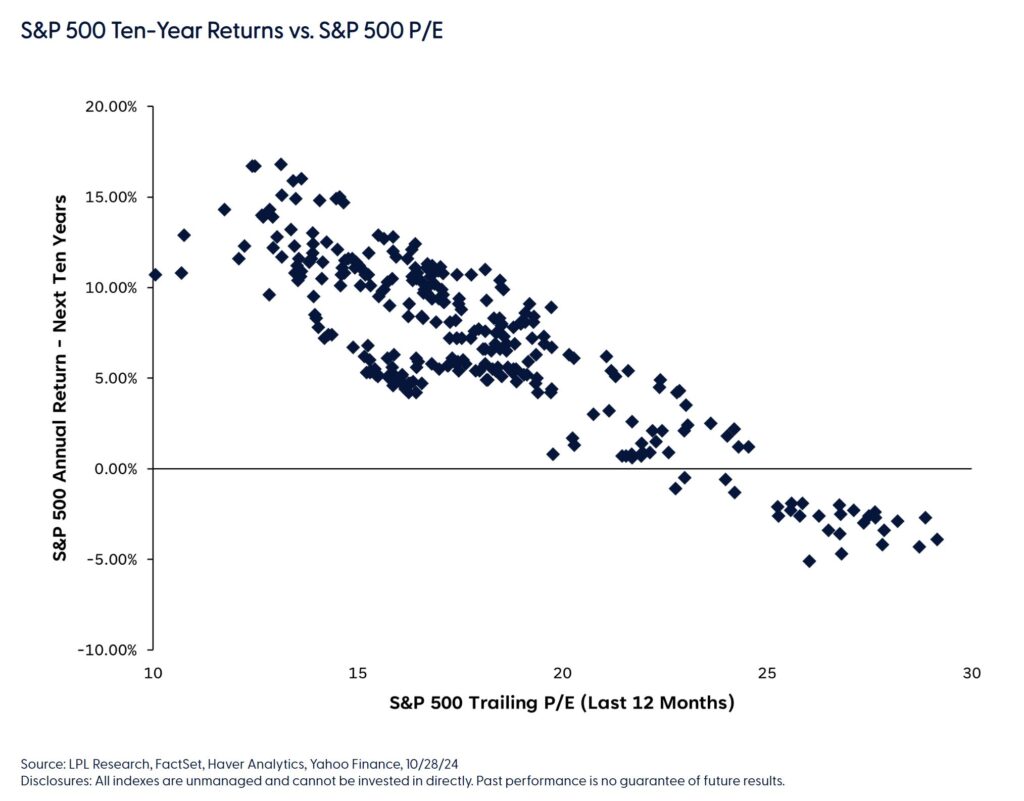

But here’s the million-dollar question: Will the bulls keep running in 2025? Anyone claiming they know for sure is probably trying to sell you something. What we do know is that history gives us some clues. The S&P 500’s price-to-earnings ratio has historically been a decent crystal ball for long-term returns – the higher the P/E, the lower the likely future returns, and vice versa. It’s not perfect, but it’s one compass we can use to navigate these choppy market waters.